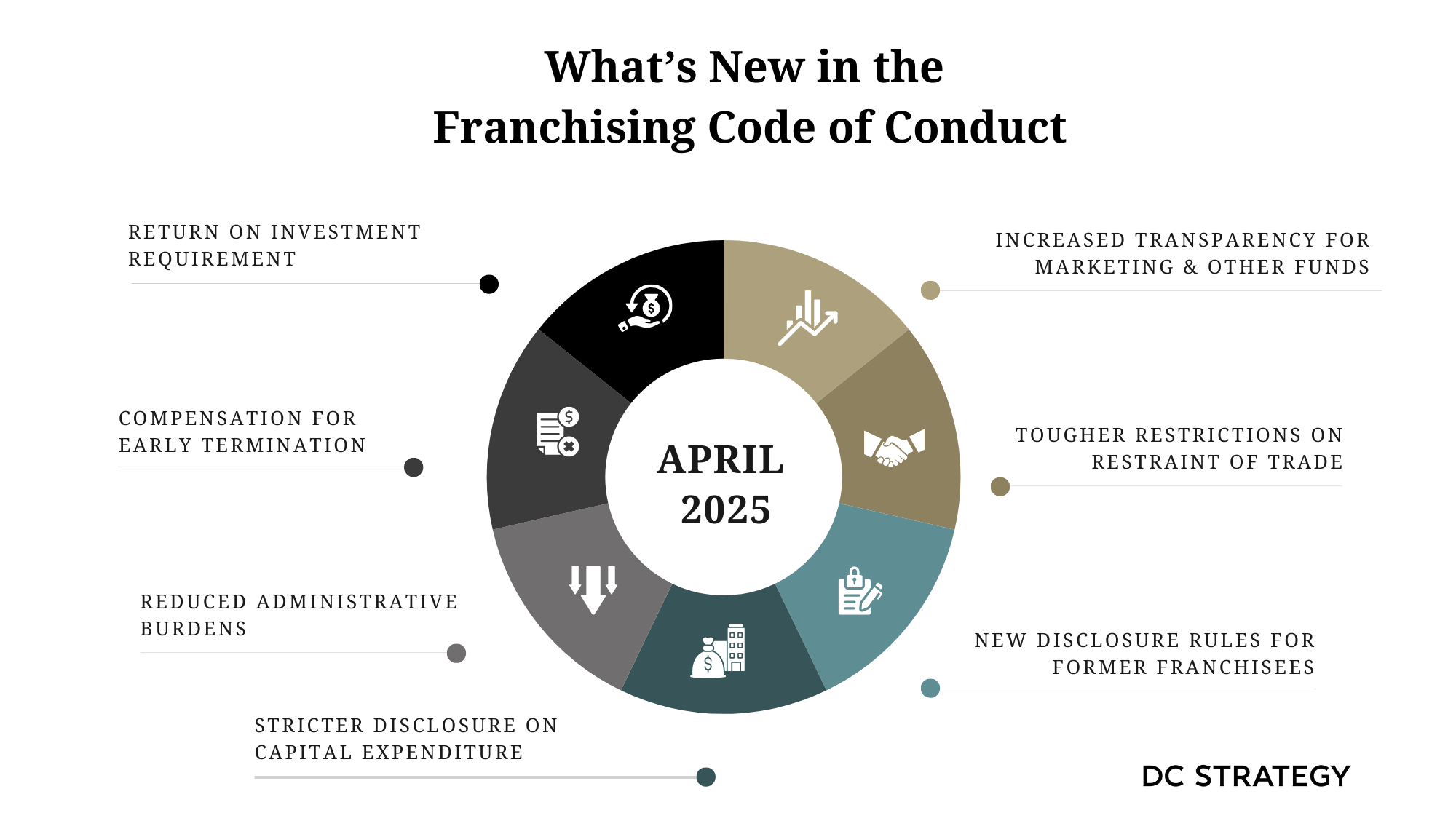

Major Changes to the Franchising Code – Are You Ready?

The Franchising Code of Conduct is undergoing significant changes, with a new Code taking effect from 1 April 2025. These updates impact franchise agreements, disclosure requirements, termination policies, and compliance obligations. Some changes apply immediately, while others roll out by 1 November 2025.

These reforms affect both franchisors and franchisees, so it’s essential to act now to ensure compliance. Below, we break down the key changes and what steps franchisors need to take.

For the full Franchising Code of Conduct, visit the Federal Register of Legislation.

Talk to our Experts

Navigating these changes can be challenging. Our team of experts is here to help you stay compliant and prepared for the new Code.

James Young is the Head of Franchise Sales & Development at DC Strategy, where he leads franchising growth initiatives and provides strategic advice to franchisors looking to expand and strengthen their networks.

Contact James for guidance on franchising ramifications and strategic planning.

Sophie Pettigrew is the Legal Practice Director at DC Strategy Lawyers, with extensive experience in franchise law, compliance, and regulatory updates. She advises franchisors on navigating legal changes, ensuring compliance, and updating agreements.

Contact Sophie for legal advice related to franchising compliance and updates.

Here's a Closer Look at the Changes

We’ve laid out the key updates and what franchisors need to do to stay compliant.

1. Transition to the New Code

The current Code remains in effect for agreements signed before 1 April 2025.

The new Code applies to agreements renewed, transferred, or extended after this date.

2. Revised Termination Rules

Franchisors can still terminate a franchise agreement with seven days’ notice, but franchisees now have dispute rights under certain conditions:

Franchisees can dispute termination if accused of:

Abandoning the business

Endangering public health or safety

Operating fraudulently

Franchisees cannot dispute termination for:

Breaches of the Migration Act 1958

Breaches of Fair Work civil remedy provisions

Other serious violations under Section 57

3. Reduced Administrative Burdens

Some compliance requirements have been removed to streamline operations:

Key Facts Sheet eliminated (subject to confirmation)

Cooling-off period opt-out for franchisees buying additional units in the same network

Disclosure Document opt-out for franchisees already operating within the same network

4. Compensation for Early Termination (Section 43)

Franchisors may now be required to compensate franchisees for early termination due to business decisions, such as:

Exiting the Australian market

Restructuring the franchise network

Changing the distribution model in a way that negatively impacts franchisees

Previously, compensation applied only to new car dealerships. Now, all franchise agreements may require compensation.

Compensation must cover:

Lost profits (direct and indirect revenue)

Unamortised capital expenditure

Loss of goodwill value

Costs associated with winding up the business

5. Ensuring Franchisees Have a Fair Return on Investment (Section 44)

The new Code mandates that franchise agreements provide a reasonable opportunity for franchisees to achieve a return on investment.

However, agreements must be fairly structured, considering:

The length of the agreement

Associated costs

Restrictions placed on franchisees

6. Greater Transparency for Marketing & Other Funds (Sections 31 & 61)

Franchisors collecting funds for marketing, training, or operations must comply with new reporting obligations.

Previously, these were called “marketing” or “cooperative” funds. Now, they are classified as “specific purpose funds” with stricter disclosure requirements.

By 1 November 2025, franchisors must:

Provide clear financial statements detailing fund usage

Maintain separate bank accounts for these funds

Ensure franchisees understand where their contributions go

7. Stricter Disclosure on Capital Expenditure (Section 20)

Franchisors must disclose all significant financial commitments required from franchisees, including:

Store renovations and refurbishments

Equipment or technology upgrades

Other major capital investments

8. New Disclosure Rules for Former Franchisees (Section 63(1))

Franchisors cannot disclose personal contact details of former franchisees in their Disclosure Documents unless:

At least 14 days before disclosure, the franchisor has advised the former franchisee that they may request that their details not be shared.

The former franchisee has not requested that their details be withheld.

Personal information includes: Name, location, telephone number, and email address.

What You Need to Do

Identify former franchisees who left the network in the last three financial years and who have already opted out of disclosure.

Email or write to former franchisees who have not opted out, informing them that they can request their details be withheld.

Provide a standard form to make it easy for former franchisees to submit their request.

Wait at least 14 days after notifying former franchisees before including their details in a Disclosure Document.

Retain records of all notices and written requests for at least six years.

9. Tougher Restrictions on Restraint of Trade (Section 42)

Restraint of trade clauses will not be enforceable if:

The franchisee had a renewal option, but the franchisor declined it.

The franchisee met all renewal conditions and was not in breach.

The franchisee was not compensated for goodwill.

What Franchisors Should Do Now

Review and update franchise agreements.

Check termination and compensation clauses for compliance.

Update disclosure documents to reflect the new rules.

Train your team on these changes.

Establish an internal process to notify and track former franchisee disclosure requests.

Seek legal guidance to avoid costly penalties.

Need Help Navigating the Changes?

To help franchisors transition smoothly, DC Strategy Lawyers is offering fixed-fee packages to assist with Code compliance. Ensure your agreements, disclosures, and internal processes are fully compliant with the latest requirements.

Contact James Young for expert advice on franchising growth, strategy, and updating your systems to meet the new Code requirements.

Connect with Sophie Pettigrew for clear legal guidance on compliance and Code updates. Sophie ensures your agreements and processes are fully aligned with the latest requirements, protecting your business from potential risks.

Final Thoughts

The new Franchising Code of Conduct marks one of the most significant regulatory updates in recent years. While some amendments simplify compliance, others introduce stricter rules around termination, compensation, disclosure, and restraint of trade.

With April 2025 fast approaching, franchisors must act now to review their agreements, policies, and processes to ensure full compliance.

📌 Need help? Contact us today to ensure your agreements, disclosures, and internal processes are compliant.